- April 8, 2022

- Posted by: admin

- Category: IP News and Updates

Signzy Technologies, a company based out of Bengaluru has announced that it has received a US patent that will enable it to provide seamless banking and financial transactions in the metaverse using Virtual and Augmented Reality.

The application for the patent titled “Method and system for onboarding users for financial institutions using virtual reality and augmented reality” was filed in late 2020. The United States Patent and Trademark Office (USPTO) granted the patent in March 2022.

The patent describes a method for real-time onboarding of customers in virtual reality, across devices, by any financial institution. The patent summarizes this innovation as:

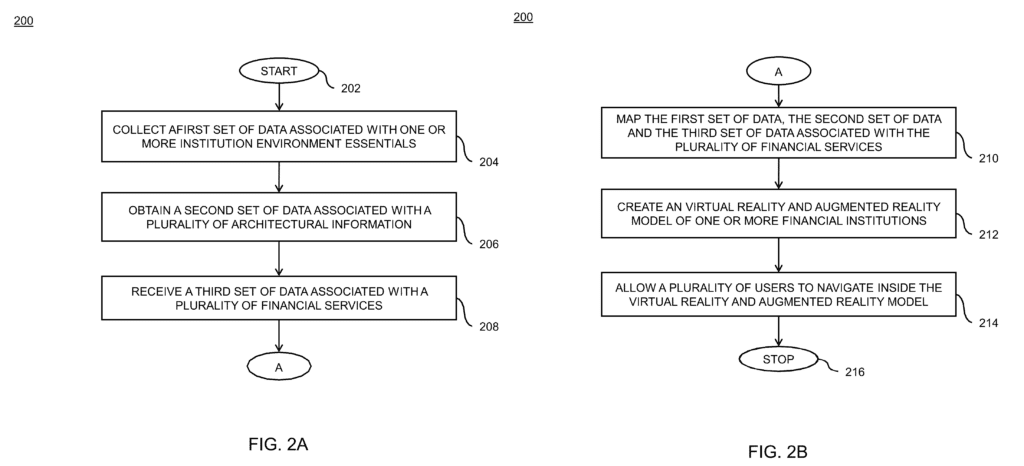

“The present disclosure provides a computer-implemented method and system for onboarding users for financial institutions using virtual reality and augmented reality. The computer-implemented method and system corresponds to a visualization based onboarding system. The visualization based onboarding system collects a first set of data. The visualization based onboarding system obtains a second set of data. The visualization based onboarding system receives a third set of data. The visualization based onboarding system maps the first set of data associated with one or more institution environment essentials, the second set of data associated with a plurality of architectural information, and the third set of data associated with a plurality of financial services. The visualization based onboarding system creates a virtual reality and augmented reality model. The visualization based onboarding system allows a plurality of users to navigate inside the virtual reality and augmented reality model of one or more financial institutions.” (Source: USPTO)

Signzy’s “visualization based onboarding system” collects various sets of data for creating virtual reality (VR) and augmented reality models. The first set of data relates to institution environment essentials e.g. walls, roof, basic building, service counters, electrical and electronic components, physical items, etc. The second set of data gathers information on the architecture of the financial institutions or banks such as blueprints, layout, sub-floor plans, roof plans, specification drawings, 2D orthogonal projections of financial institutes, sections, elevations, and interior plans, and exterior plans, etc. Additionally, the third set of data is associated with the financial services of the banks, which include enquiry services, various loan services, net banking services, commercial banking services, stock exchange investment, account opening services, documents verification services, insurance & retirement plan services and many more.

All three sets of data are mapped to create a VR and augmented reality model of the financial institution. The users can experience and navigate the real environment of the financial institutions on wearable and handheld VR and augmented reality devices as the 3-D virtual space.

This method enables the customers to interact with their bank in a virtual reality (VR) model that perfectly reproduces a physical bank branch or office. The customers can access various services offered by the bank in real-time while navigating through the VR model of the bank and can upload different documents required for the onboarding process.

Ankit Ratan, co-founder of Signzy, said the grant of this patent is a breakthrough innovation for banking in the metaverse and emphasized the importance of the metaverse and its impact on businesses in the near future.

The recent buzz around the metaverse can be attributed to Facebook’s rebranding to ‘Meta’ in 2021. However, the expression is much older than we think. It was coined by Neal Stephenson in his sci-fi novel Snow Crash almost 30 years ago. Metaverse offers to change many aspects of our life, including learning, working, and socializing. Banking in the metaverse can bring an emotionally enriched experience for the tech-savvy generation who might find the traditional process dull. In addition, the virtual space can offer a safe space for meaningful interactions during a global pandemic.